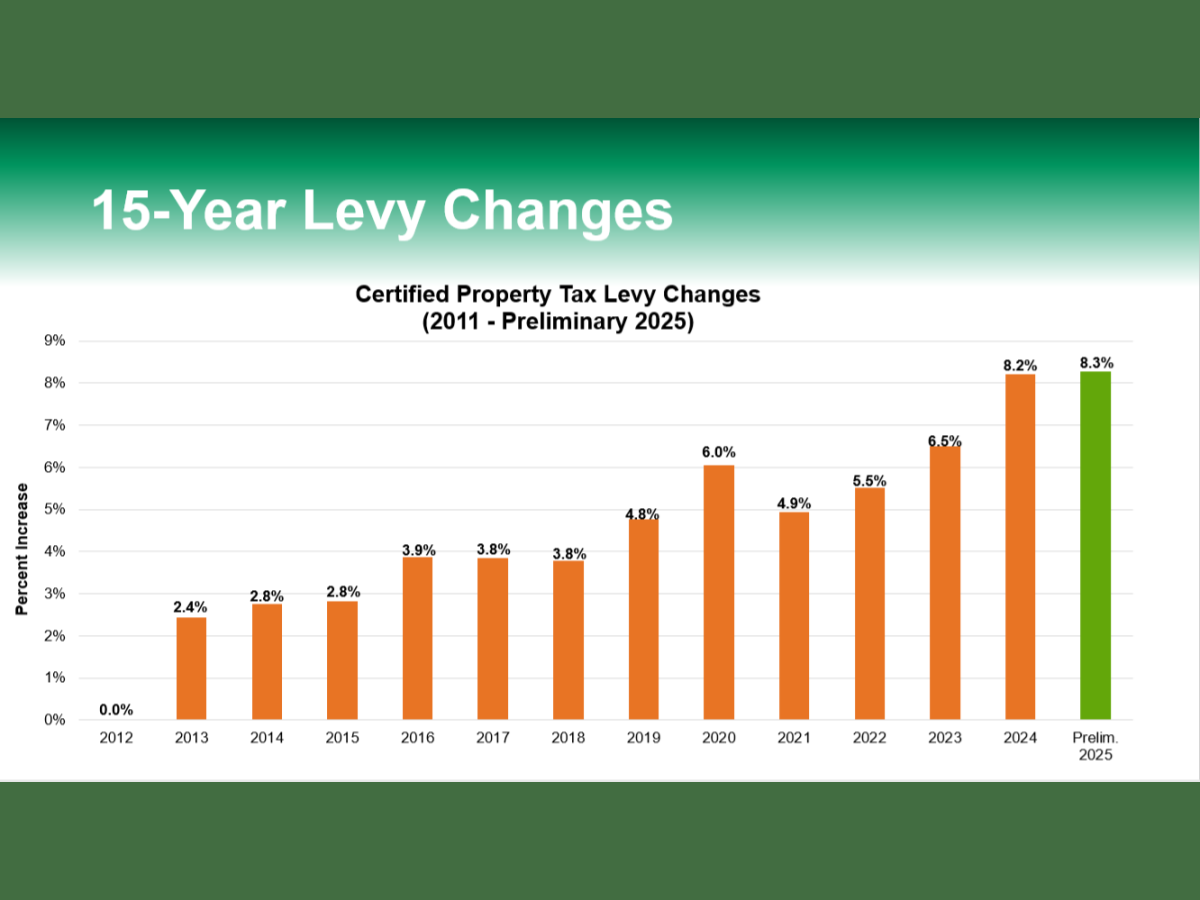

The Woodbury City Council gave final approval to the 2025 budget that includes an 8.3% property tax rate increase.

“The growth of the city has really frankly outstripped the staff’s ability to provide effective services,” City Administrator Clint Gridley said in his presentation to the council at its Dec. 11 meeting.

He said for years after the Great Recession that began in December 2007 tax increases were limited even as the city’s population boomed, so recent increases in spending on city services are an attempt to catch up.

The council voted after its Truth in Taxation public hearing, which is the culmination of months of public meetings and discussion on the budget and taxes.

The $139 million budget includes 23 new positions with 10.6 of them supported by the tax levy and the other positions supported by revenue from sources like grants and fees. Eleven of the positions will add to the public safety team. Six paramedic/firefighters are being added, as well as an ambulance, to handle increased medical calls. Two police officer positions will move the city closer to its goal of having one police officer per 1,000 people.

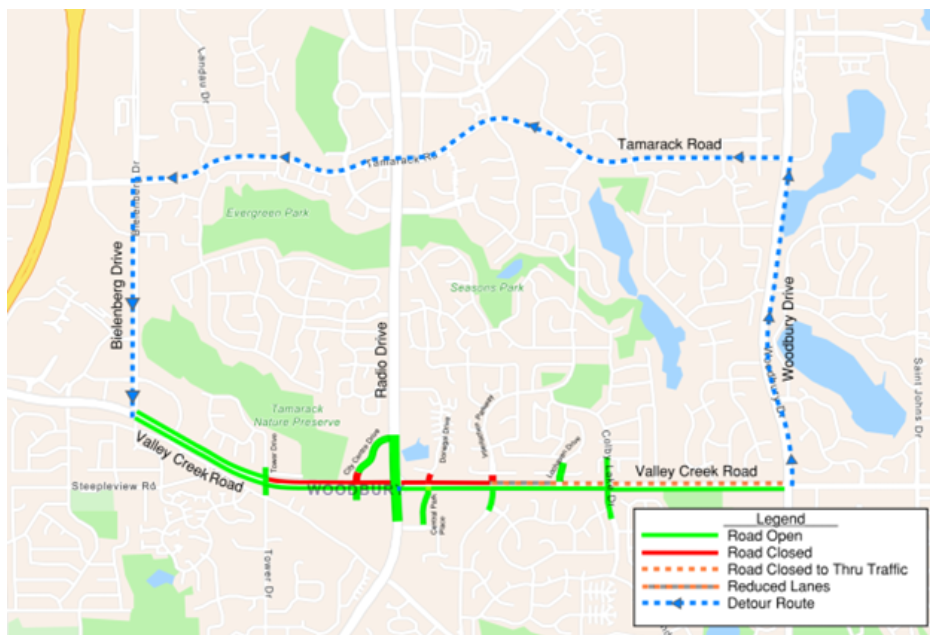

Another 2.6 positions are being added to staff Central Park, which is being renovated and expanded. That $42 million project is one of the city’s key capital projects. Gridley also highlighted the $350 million Waste Water Treatment Plant and infrastructure, the $60 million Public Safety Campus funded mainly by an increased sales tax, and $23.3 million for road and trail resurfacing.

Property values drop slightly

Woodbury has seen consistent, above-average growth in residential and property values for years, but the trend is expected to end in 2025. The median home value in 2024 was $456,000 while next year it is estimated to be $441,100.

Gridley said even with the slight drop, residential values in the city are up substantially since 2016 when the median home value was $277,100

“What’s been happening up until this year is that the market value – growth – has been greater than the levy growth, which means the tax rate comes down,” Gridley said.

He called the drop in values in 2025 “a very unusual circumstance.”

For the median home value of $441,000, the city says the owner’s tax bill will climb from $1,279 per year to $1,352, an increase of $73 which includes the assumed decrease in value of 3.4 percent.

The city says 12 percent of homeowners will see a tax decrease and 88 percent tax will see a tax increase.

Gridley added that Woodbury had the fifth lowest tax rate out of 20 cities in the metro area. The 8.3 percent rate increase is lower than both the metro average and state average.

Council members Andrea Date, Steve Morris, Jennifer Santini and Mayor Anne Burt voted to approve the budget and tax rate while council member Kim Wilson voted against approval.